Why padel is on the rise

Rapid growth of infrastructure & participation

As of 2024, over 50,000 padel courts globally, with ~7,200 new courts added in that year alone.

~3,282 new padel clubs opened worldwide in 2024 (nearly one every 2.5 hours).More than 90 countries now have padel infrastructure and/or federations.

Strong retention and appeal

A very high return rate: about 92% of people come back after trying padel once.

It’s socially engaging, relatively easier to pick up than some traditional racket sports (tennis especially), which lowers barriers to entry.

Economic potential

The market is growing fast. One report estimates the global padel clubs market will reach ~€6 billion by 2026.

Equipment (rackets, balls, etc.), court construction, club operations, tournaments, etc., provide multiple revenue streams.

Geographic expansion

While Spain, Argentina, Italy, and Sweden have been early/strong adopters, growth is surging in places like the UK, US, parts of Asia, the Middle East.

In the U.S., for example, padel is still early-stage but showing signs of accelerating infrastructure development.

Media, tournaments, visibility

More tournaments are being held in more countries; more players competing globally

Luxurious resorts and hospitality businesses are adding padel courts as amenities, which helps raise its profile.

Challenges & uncertainties

While the outlook is positive, there are nontrivial risks and hurdles to overcome for padel to sustain its growth and become “mainstream” in many markets.

Competition from other racket / social sports

Pickleball (especially in the U.S.) is a strong competitor. It often needs less space, lower cost, and is easier to adapt existing surfaces.

Tennis is entrenched in many communities; changing mindset and infrastructure is not trivial.

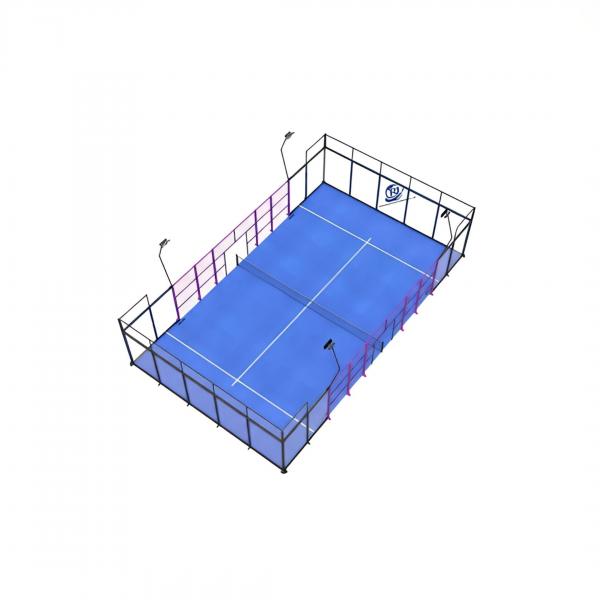

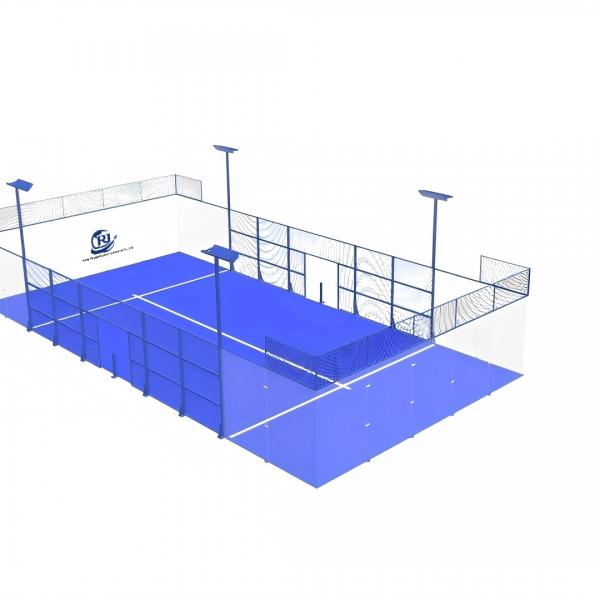

Infrastructure costs & logistics

Building courts, especially indoor ones, can be expensive (land, materials, permits, maintenance, climate control if needed).

In some places, zoning, real estate costs, or climate make building indoor or permanent courts harder/expensive.

Awareness / culture / tradition

In many markets padel is still new, so awareness is low; people might not know about it, or have no access to courts or coaching.

Changing cultural preferences takes time (e.g. in U.S., people are more familiar with tennis, basketball, etc.).

Seasonality & weather

Outdoor courts are subject to weather; indoor courts help but increase cost.

In places with harsh winters or very hot summers, indoor play is required, adding cost.

Sustainable business models

Clubs need good utilization to be profitable. Empty courts or irregular bookings can kill margins.

Equipment saturation / competition among brands could drive down margins.

Regulation, governance, standardization

As the sport scales, federations, tournament organization, standard equipment, coaching certification etc. need to catch up to ensure quality.

Olympic inclusion has been discussed, but not yet confirmed; that could affect funding / recognition.

Conclusion: Is it the “next hot spot”?

Yes — all signals suggest padel is moving beyond niche into mainstream in many parts of the world. It has a lot of the ingredients: accessible, social, scalable infrastructure, high retention, growing investments, strong appetite especially among younger and more urban populations.

But whether it becomes as big or bigger than some other major racket or fitness sports depends on:

How well it scales in large markets like the U.S., China, India, etc.

How efficiently clubs can manage cost vs utilization.

How strong the ecosystem becomes — coaching, media coverage, sponsorship, tournaments.

Whether awareness and culture follow the infrastructure: people need to want to play, not just have courts built.